Yes, you can send tax documents via email, but it’s not always safe. Email can be intercepted, leading to potential identity theft.

Sending tax documents is a sensitive matter. Tax documents contain personal information like Social Security numbers and financial details. These details need protection. Emailing them can be risky due to hackers and cyber threats. It’s crucial to understand the risks and learn how to protect your information.

In this blog post, we will discuss the safety concerns, potential risks, and best practices for sending tax documents via email. By the end, you’ll know how to keep your data safe and whether emailing tax documents is the right choice for you. In this blog post, we will discuss the safety concerns, potential risks, and best practices for sending tax documents via email. By the end, you’ll know how to keep your data safe and whether emailing tax documents is the right choice for you. We’ll explore the essential safety measures you can implement to protect sensitive information, such as using encryption and secure passwords. Additionally, we will highlight safe email practices for tax documents to ensure that both senders and recipients can confidently manage their financial data. By following these guidelines, you can minimize the risk of identity theft and unauthorized access.

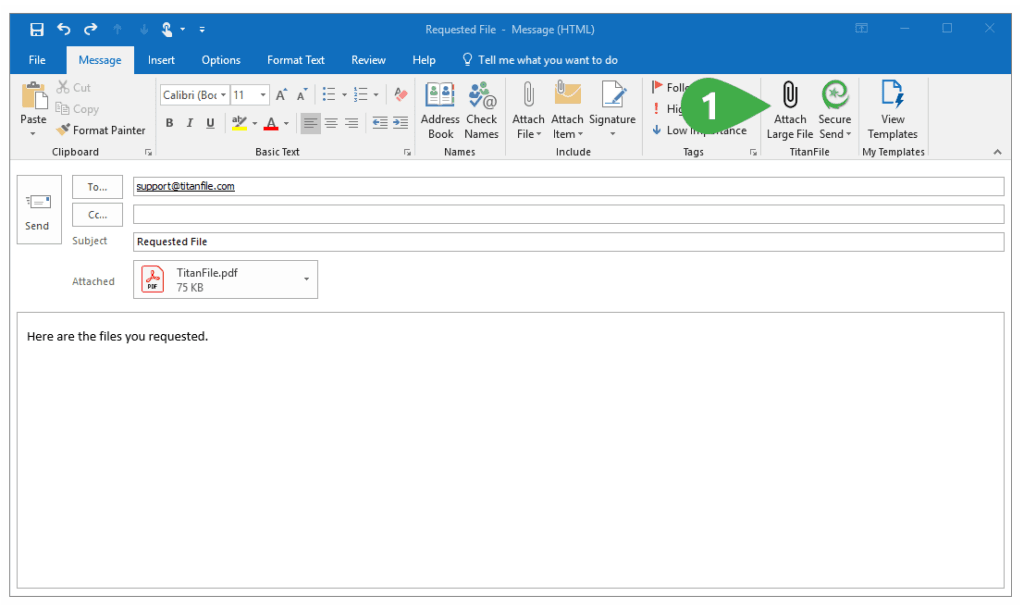

Credit: quickbooks.intuit.com

Emailing Tax Documents

Emailing tax documents might seem simple. You can send files quickly. Yet, it has its benefits and risks. This section will cover both. We will also discuss common concerns people have about emailing tax documents. While the convenience of sending files like tax documents is appealing, it’s essential to consider security measures to protect sensitive information. For example, if you choose to send a Word document via email, ensure that it is encrypted or password-protected to prevent unauthorized access. Additionally, be aware of the potential for phishing attacks that could compromise your personal data during the process. Another option to enhance security is to use secure file-sharing services that offer encryption and access controls. While these alternatives allow you to scan and email documents easily, it’s crucial to verify the service’s reputation and security measures. Ultimately, being proactive about your document security can help safeguard your sensitive information from potential threats.

Benefits And Risks

Emailing tax documents saves time. You avoid trips to the post office. It is convenient. You can send documents from your home. There are no paper copies to store. Additionally, emailing tax documents allows for easy organization and retrieval. Should you need to reference a previous submission, you can easily save an email as a document and keep it accessible. This digital method also reduces the risk of losing important papers, giving you peace of mind.

But risks exist too. Emails can be hacked. Sensitive information might be exposed. Identity theft is a real threat. Once sent, you cannot take the email back. Think carefully before hitting send. Additionally, you should consider the recipient’s schedule and whether they are likely to be available to respond. Understanding what time is appropriate to email can significantly impact the effectiveness of your communication. By being mindful of these factors, you can help ensure your message is received in the intended manner.

Common Concerns

Many worry about security. They fear their information could be stolen. Encryption can help. It makes your email harder to read for others. But not everyone uses it.

Another concern is sending to the wrong address. Double-check the recipient’s email. Mistakes happen. A wrong email could lead to a data breach. Be cautious.

Lastly, some ask if emailing tax documents is legal. It is, but rules vary by country. Check local guidelines. Ensure you comply with the law.

Credit: advicepay.helpscoutdocs.com

Legal Considerations

Sending tax documents via email involves several legal considerations. These considerations help ensure compliance with laws and protect sensitive information. Understanding these factors is critical for both individuals and businesses. Additionally, using secure methods for transmitting tax documents, such as encrypted emails, can mitigate risks of unauthorized access. It’s also important to be aware of how payment platforms like Venmo can influence tax reporting; for instance, Venmo business accounts and payments may require different documentation and record-keeping practices. Individuals and businesses must stay informed about these regulations to avoid potential penalties or issues with their tax filings. The security of the transmission method must also be taken into account, as unsecured emails can lead to data breaches. Additionally, individuals often wonder, ‘is email considered a legal document‘ in the context of tax submissions, as the acceptance of electronic formats varies by jurisdiction and specific regulations. Therefore, ensuring proper encryption and compliance with electronic record-keeping laws is essential for safeguarding both the sender’s and recipient’s interests.

Regulations And Compliance

Various laws govern the transmission of sensitive data. The IRS has specific rules for sending tax documents electronically. Email may not always meet these standards. Compliance involves using secure methods, such as encrypted email services. Failing to comply with these regulations can lead to serious consequences.

Penalties For Breaches

Violating these laws can result in hefty fines. Unauthorized disclosure of tax information can lead to penalties. Individuals and businesses may face legal action. This underscores the importance of following proper procedures. Ensuring secure transmission methods is not only best practice but also a legal requirement.

Choosing Secure Platforms

Sending tax documents via email poses security risks. Consider using secure platforms to protect sensitive information. Encryption and secure file transfer services offer better protection for your confidential data.

Sending tax documents via email can be convenient, but it also raises concerns about security. Choosing the right platforms is crucial to ensure your sensitive information doesn’t fall into the wrong hands. Let’s delve into some secure platforms that can help you send tax documents safely.

Trusted Email Providers

Not all email providers are created equal. Some offer enhanced security features specifically designed to protect sensitive information. Gmail, for instance, provides robust security measures, including two-step verification and suspicious activity alerts.

ProtonMail is another excellent choice. It offers end-to-end encryption, ensuring that only you and the recipient can read the emails. It’s worth considering if you regularly send sensitive information.

Encryption Services

Encryption is a must when sending tax documents via email. It scrambles your data, making it unreadable to unauthorized users. There are several services you can use to encrypt your emails.

PGP (Pretty Good Privacy) is one such service. It encrypts your emails and attachments, providing an additional layer of security.

Another option is using email encryption tools like Virtru. It integrates with popular email providers and adds encryption to your emails without much hassle.

So, how secure is your email? Are you using encryption? If not, it’s time to start.

Taking these steps can help you send tax documents via email safely. Remember, your financial data is too important to leave unprotected. Choose secure platforms, and stay vigilant.

Credit: www.kgw.com

Encryption Techniques

Sending tax documents via email can be risky. Sensitive information could fall into the wrong hands. Encryption techniques offer a solution to this issue. Encrypting emails ensures that only the intended recipient can read the message. This added layer of security is crucial for protecting personal data.

Types Of Encryption

There are different types of encryption for emails. The most common include symmetric and asymmetric encryption. Symmetric encryption uses one key for both encryption and decryption. The sender and receiver share this key. This method is fast but less secure.

Asymmetric encryption uses two keys: a public key and a private key. The public key encrypts the message. The private key decrypts it. This method is more secure but slower. It ensures that even if the public key is shared, the message remains safe.

How To Encrypt Emails

Encrypting emails is not as hard as it sounds. First, choose an email service that supports encryption. Some popular services include ProtonMail and Tutanota. These services offer built-in encryption. They make it easy to secure your emails.

If you use a regular email service, you can still encrypt your emails. Use software like GnuPG or PGP. These tools offer strong encryption. They integrate with most email clients. Follow the setup instructions carefully. Once set up, encrypt your message before sending it.

Another option is to use a plugin. Many email clients offer encryption plugins. For example, Mailvelope is a popular choice for Gmail and Outlook users. These plugins add encryption features to your existing email service. They offer a simple way to secure your messages.

Remember to share your public key with your recipient. They need it to read your encrypted emails. Keep your private key safe. Do not share it with anyone. Use strong passwords to protect your encryption keys.

Password Protection

Sending tax documents via email can be risky. Password protection adds an extra layer of security, ensuring sensitive information remains safe. Always encrypt documents before sharing them.

When sending tax documents via email, one of the most crucial steps is ensuring they are password-protected. This extra layer of security helps safeguard sensitive information from unauthorized access. Let’s explore how you can create strong passwords and share them securely.

Creating Strong Passwords

A strong password is essential for protecting your tax documents. Use a mix of uppercase letters, lowercase letters, numbers, and special characters. Aim for at least 12 characters to make it harder for hackers to guess.

Avoid using easily guessable information like birthdays or common words. Instead, combine unrelated words or use a passphrase. For instance, “BlueMonkey$45&Sunshine!” is much stronger than “Password123”.

Consider using a password manager to generate and store complex passwords. This way, you don’t have to remember each one, and it minimizes the risk of using weak or repeated passwords.

Sharing Passwords Securely

Never share passwords via the same email containing the tax documents. This practice defeats the purpose of password protection. Use a different communication channel, such as a phone call or text message.

If you’re using a messaging app, ensure it has end-to-end encryption. Apps like Signal or WhatsApp are good choices for securely sharing passwords.

Additionally, you might set an expiration date for the password. Change it after a specified period or once the recipient has accessed the document. This reduces the likelihood of the password being reused or compromised.

Have you ever thought about how easy it might be for someone to access your sensitive information if your password is weak or shared insecurely? By taking these steps, you can significantly reduce the risk and keep your tax documents safe.

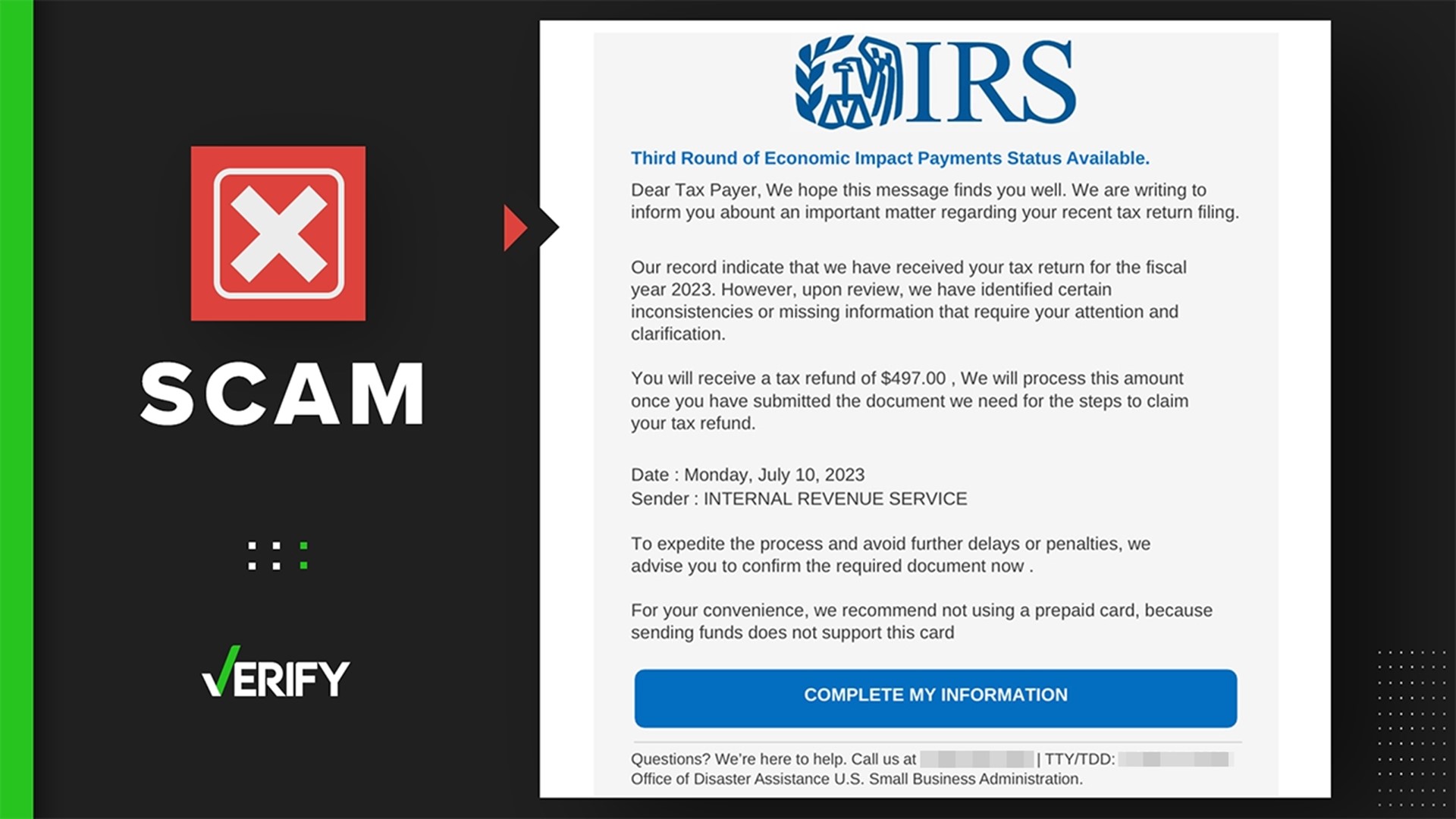

Identifying Phishing Scams

Sending tax documents via email can be risky. Identifying phishing scams is crucial to protect your sensitive information. Phishing scams often trick people into giving away personal data. Knowing the signs can save you from fraud.

Common Phishing Techniques

Phishing emails often look real. They may use logos of well-known companies. The sender’s address might be similar to a trusted source. These emails usually create a sense of urgency. They might say your account is at risk. The email often includes a link or an attachment. Clicking these can install malware on your device. Scammers might ask for personal details. Never share your social security number or bank details through email.

Preventing Email Fraud

To avoid email scams, stay alert. Always check the sender’s email address. Block emails which are sent from no valid senders. Look for spelling errors or strange language. Legitimate companies rarely ask for sensitive info via email. Use strong, unique passwords for your accounts. Enable two-factor authentication where possible. Keep your software updated. This includes your email client and antivirus programs. Be cautious with unsolicited emails. If something feels off, verify through another method. Contact the company directly using a trusted phone number. Do not use the contact details in the suspicious email. Additionally, consider setting up a separate email account for newsletters and promotional offers to help manage your inbox. This way, you can keep your primary account more secure while still exploring ways to learn about new products and services. For those curious, there are even guides on how to ethically sign up for spam to see what types of marketing solicitations are out there without compromising your main email address.

Regular Security Audits

Regular security audits are vital for ensuring the safe handling of tax documents via email. These audits help identify and fix security vulnerabilities. This practice ensures your sensitive information stays protected from unauthorized access.

Importance Of Audits

Regular audits help maintain a secure email system. They identify potential risks and flaws. This proactive approach protects your data from breaches.

Audits help in meeting regulatory compliance. Following legal standards helps avoid penalties. Regular checks show your commitment to data security.

Steps For Conducting Audits

Start by assessing your current security measures. Check the encryption protocols in place. Ensure they are up to date.

Review access controls. Verify that only authorized personnel can access sensitive information. Keep a log of access activity.

Test your email system for vulnerabilities. Use security tools to scan for weaknesses. Address any issues immediately.

Conduct regular training sessions. Teach staff about the importance of security. Ensure they follow best practices.

Document your audit findings. Keep a record of all identified issues and actions taken. This helps in future audits.

Best Practices

Sending tax documents via email can be risky. Sensitive information needs protection. Following best practices ensures safety. Below are essential steps to secure your documents.

Maintaining Confidentiality

Always use encryption when sending tax documents. This adds a layer of protection. Encrypt the email and attachments. This keeps unauthorized people from accessing the information. Use software like Adobe Acrobat for encrypted PDFs. Ensure your email provider supports encryption.

Avoid sending tax documents over public Wi-Fi. Public networks are less secure. Use a secure, private connection instead. This reduces the risk of interception. Check your email provider’s security policies. Choose one with strong security measures in place.

Using Multi-factor Authentication

Enable multi-factor authentication (MFA) on your email account. MFA requires two or more verification methods. It adds extra security. A password alone is not enough. Combine it with a text message code or fingerprint scan. This makes it harder for hackers to access your account.

Notify the recipient to use MFA as well. Both parties need secure access. This ensures the safety of your tax documents. Regularly update your passwords. Use complex and unique passwords for added security.

Frequently Asked Questions

Is It Safe To Send Tax Documents By Email?

Sending tax documents by email is risky. Hackers can intercept emails and steal sensitive information. Use encrypted email services or secure file-sharing platforms.

What Is The Best Way To Send Tax Documents Online?

Use a secure file-sharing service like Dropbox or Google Drive. Encrypt the documents before sending. Use strong passwords and two-factor authentication for extra security.

Is It Safe To Send Financial Documents Via Email?

Sending financial documents via email can be risky. Use encrypted email services or secure file-sharing platforms for safety. Avoid sending sensitive information through regular email. Additionally, consider using password-protected files to add another layer of security. When securely sending documents via email, always verify the recipient’s email address to ensure the information reaches the intended party. Regularly updating your passwords and using two-factor authentication can further enhance your document security.

Is It Safe To Send My W2 Over Email?

Sending your W2 over email is not safe. Use encrypted methods or secure file transfer services instead.

Conclusion

Sending tax documents via email can be risky. Always ensure your email is secure. Encrypt files for added protection. Consider using secure portals or physical mail. Protect your sensitive information. Consult a tax professional for advice. Stay safe and compliant with tax regulations.