No, it is not safe to send tax documents via email. Emails can be intercepted and sensitive information can be stolen.

Tax season is stressful. You gather all your documents and then wonder about their safety. Sending tax documents via email seems convenient. But, is it safe? Cybersecurity threats are real and growing. Hackers look for vulnerable data. Your tax documents contain personal details.

This makes them a prime target. To protect yourself, you need to understand the risks. Learn safer ways to share sensitive information. This blog will explain why email is risky. It will also offer secure alternatives. Stay informed and protect your personal data.

Common Risks

Sending tax documents via email might seem convenient. Yet, it comes with its own set of risks. Understanding these risks can help you make informed decisions. This section will focus on common risks associated with emailing tax documents.

Email Vulnerabilities

Email accounts are often targets for hackers. They search for sensitive information. An email with tax documents can be intercepted. This can lead to identity theft. Hackers can use your information for illegal activities.

Phishing attacks are another threat. Fake emails look like they come from trusted sources. They trick you into sharing personal data. Always verify the sender’s email address. Be cautious with attachments and links.

Data Breaches

Data breaches can occur at any time. They compromise the security of your email. Large companies and service providers are often targets. Your tax documents may be exposed during a breach. This can lead to unauthorized access to your financial data.

Use strong passwords to protect your email account. Change passwords regularly. Enable two-factor authentication for added security. These steps can help minimize the risk of data breaches.

Phishing Scams

Sending tax documents via email can be risky due to phishing scams. Hackers may steal sensitive information. It’s safer to use secure methods.

Phishing scams are a significant threat when sending tax documents via email. Cybercriminals often disguise themselves as legitimate entities to steal sensitive information. These scams are becoming more sophisticated, making it crucial to stay vigilant.

Recognizing Phishing

Phishing emails often look genuine. They might use official logos and professional language. However, there are subtle signs you can spot.

Check the sender’s email address carefully. Often, it will have slight misspellings or unusual domain names. Be wary of urgent language that pressures you to act quickly.

Look for generic greetings such as “Dear Customer.” Legitimate emails usually address you by name. Also, hover over links without clicking. This reveals the true URL, which can help you detect suspicious links.

Preventing Scams

Use strong, unique passwords for your email accounts. Enable two-factor authentication (2FA) for an added layer of security. This makes it harder for hackers to gain access.

Be cautious about the information you share online. Cybercriminals gather personal details from social media to craft convincing phishing emails. Limit the data you post publicly.

Educate yourself and others about common phishing tactics. Share tips with family and friends to help them stay safe. Consider subscribing to cybersecurity newsletters for the latest updates.

Is sending tax documents via email worth the risk? Instead, explore secure alternatives like encrypted file-sharing services. These options provide better protection for your sensitive information.

By recognizing and preventing phishing scams, you can safeguard your tax documents and personal data. Stay informed and alert to protect yourself from these ever-evolving threats.

Encryption

When sending sensitive information like tax documents via email, the security of your data is paramount. This is where encryption comes into play. Encryption protects your information from unauthorized access, ensuring that only the intended recipient can read it.

How Encryption Works

Encryption transforms your readable data into an unreadable format. This is achieved using algorithms that scramble the information.

Only someone with the correct decryption key can revert the data back to its original form. Think of it like a lock and key system where only the person with the key can unlock the message.

For email, this often means using encryption tools or services that automatically encrypt your messages and attachments.

Benefits Of Encryption

First and foremost, encryption keeps your sensitive information secure. This means that even if someone intercepts your email, they won’t be able to read your tax documents.

Encryption also helps in maintaining privacy. Your personal financial information remains confidential, seen only by you and your tax preparer.

Moreover, using encryption can protect you from identity theft. Encrypted tax documents are much harder for criminals to exploit.

Have you ever felt uneasy sending your tax documents through email? Encryption can offer peace of mind by ensuring your data is safe and secure. Imagine the relief of knowing your sensitive information is protected from prying eyes.

Credit: www.keepersecurity.com

Secure Email Services

Sending tax documents via email can be risky if not done properly. Secure email services offer a safer way to transmit sensitive information. These services encrypt your emails, protecting them from unauthorized access. Choosing the right secure email service is crucial for ensuring your documents remain confidential.

Choosing A Provider

Selecting a secure email provider requires careful consideration. You need a service that prioritizes security and user privacy. Look for providers known for their strong encryption protocols. Check user reviews to see if the service has a good reputation. Reliability is key in making sure your emails are protected.

Features To Look For

A secure email service should offer end-to-end encryption. This means only the sender and receiver can read the email. Two-factor authentication adds another layer of security. It requires you to verify your identity in two different ways. Another important feature is the ability to set email expiration dates. This ensures your emails are only accessible for a limited time.

Make sure the provider offers secure storage. Your emails should be stored in an encrypted format. This keeps them safe even if the service gets hacked. User-friendly interfaces are also important. You want a service that is easy to use. Finally, check if the provider offers customer support. Quick help can be crucial if you face any issues.

Alternatives To Email

Sending tax documents via email can pose security risks. Sensitive information may be intercepted by hackers. Thankfully, there are safer alternatives to email for sending tax documents. These methods provide more security and peace of mind.

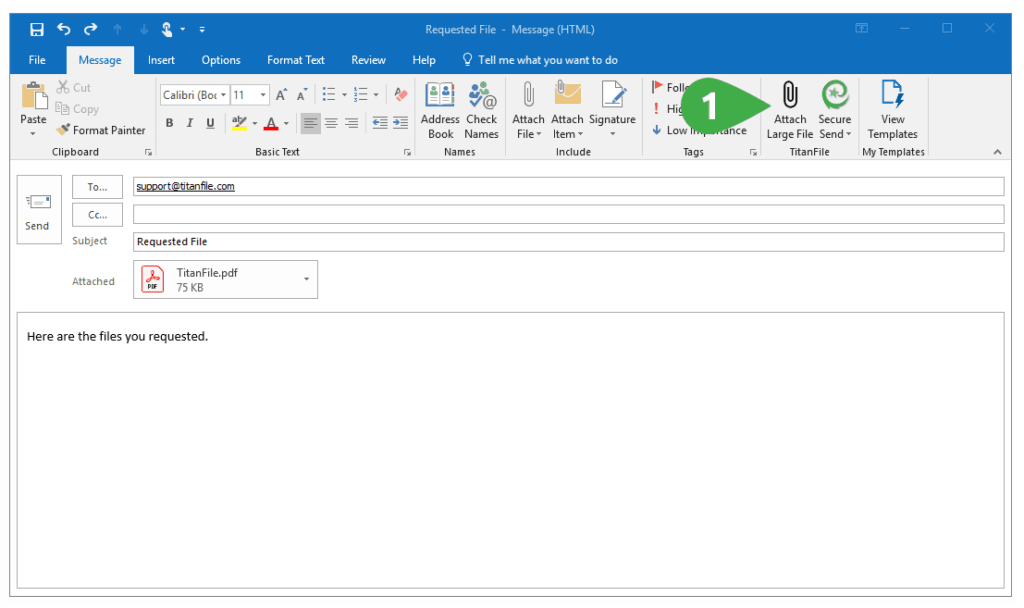

Secure File Sharing Platforms

Secure file sharing platforms offer a safer way to send tax documents. These platforms use encryption to protect your files. This means that only the intended recipient can access the documents. Platforms like Dropbox, Google Drive, and OneDrive have built-in security features. They allow you to share files with specific people. You can also set permissions to control who can view or edit the files. Always ensure you are using a reputable and secure platform.

Physical Delivery

Physical delivery is another safe method. You can use services like USPS, FedEx, or UPS. These services provide tracking and delivery confirmation. They ensure that your tax documents reach the correct recipient. Using physical delivery reduces the risk of digital interception. It is a reliable option for sending sensitive information. Remember to use a secure and traceable method for added peace of mind.

Credit: www.virtru.com

Tips For Safe Sending

Sending tax documents via email can be risky. However, there are ways to make it safer. By following certain tips, you can protect your sensitive information. These measures will help you ensure your documents are sent securely.

Password Protection

Always password-protect your tax documents. This adds an extra layer of security. Use strong, unique passwords. Avoid using common words or easily guessed phrases. Consider using a password manager to create and store strong passwords.

Verify Recipients

Ensure you send your documents to the correct recipient. Double-check the email address. A small mistake can send your documents to the wrong person. Ask the recipient to confirm receipt. This ensures your documents reached the right hands.

Credit: advicepay.helpscoutdocs.com

Frequently Asked Questions

What Is The Most Secure Way To Mail Tax Documents?

Mail tax documents using certified mail with a return receipt. This provides tracking and confirmation of delivery.

Is It Safe To Send Financial Documents Via Email?

Sending financial documents via email can be risky. Use encrypted services or secure file-sharing platforms for better protection.

Is It Safe To Send My W2 Over Email?

Sending your W2 over email isn’t safe. Use encrypted methods or secure file-sharing services instead. Protect your personal information.

What Is The Safest Way To Mail Your Tax Return To The Irs?

Mail your tax return to the IRS using certified mail with a return receipt. This ensures safe and tracked delivery.

Conclusion

Sending tax documents via email carries certain risks. Email can be intercepted. Sensitive information might be exposed. Encrypt your documents for better security. Consider alternative secure methods. Protecting your data is crucial. Always stay vigilant. Ensure you follow best practices.

Your financial safety matters most. Make informed decisions about document sharing. Stay safe and secure online.